The U.S. economy strengthened at its fastest rate in three years during Q3. Here are the five things we learned from U.S. economic data released during the week ending December 1.

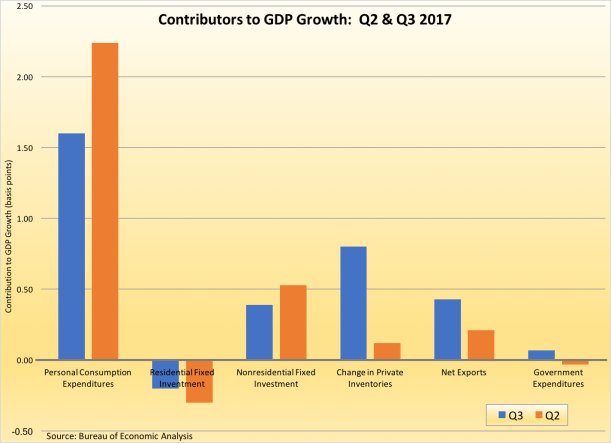

Economic growth was more vigorous than previously believed during Q3. The Gross Domestic Product (GDP) grew 3.3 percent on a seasonally adjusted annualized rate (SAAR) during July, August, and September. This was an upward revision from the 3.0 percent annualized gain previously reported by the Bureau of Economic Analysis and the fastest pace of GDP growth since the third quarter of 2014. The revision was the result of higher than previous levels of nonresidential (business) fixed investment, state/local government spending, and private inventory accumulation. Following the revision, the largest positive contributors to Q3 economic growth were personal spending (adding 160-basis points to GDP growth), the change in private inventories (+80-basis points), nonresidential fixed investment (+58-basis points), net exports (+43-basis points), and government expenditures (+8-basis points). The only major component of GDP dragging down Q3 economic growth was residential fixed investment, which cost 20-basis points in economic growth during the quarter. The same report shows that business profits (based on current production) jumped 4.3 percent during Q3 to an annualized rate of $2.215 trillion, up 5.4 percent from the same quarter a year earlier. The BEA will revise its Q3 GDP estimate once again later this month.

Economic growth was more vigorous than previously believed during Q3. The Gross Domestic Product (GDP) grew 3.3 percent on a seasonally adjusted annualized rate (SAAR) during July, August, and September. This was an upward revision from the 3.0 percent annualized gain previously reported by the Bureau of Economic Analysis and the fastest pace of GDP growth since the third quarter of 2014. The revision was the result of higher than previous levels of nonresidential (business) fixed investment, state/local government spending, and private inventory accumulation. Following the revision, the largest positive contributors to Q3 economic growth were personal spending (adding 160-basis points to GDP growth), the change in private inventories (+80-basis points), nonresidential fixed investment (+58-basis points), net exports (+43-basis points), and government expenditures (+8-basis points). The only major component of GDP dragging down Q3 economic growth was residential fixed investment, which cost 20-basis points in economic growth during the quarter. The same report shows that business profits (based on current production) jumped 4.3 percent during Q3 to an annualized rate of $2.215 trillion, up 5.4 percent from the same quarter a year earlier. The BEA will revise its Q3 GDP estimate once again later this month.

Consumer spending barely budged in October. The Bureau of Economic Analysis reports that personal consumption expenditures (PCE) increased 0.3 percent during the month to a seasonally adjusted annualized rate (SAAR) of $13.557 trillion, up 0.3 percent from September. But after adjusting for inflation, “real” PCE grew only 0.1 percent during October following a 0.5 percent bounce in September (although some of September’s spending surge reflected hurricane-related automobile purchases). Real spending on goods grew 0.3 percent, split between a 0.5 percent gain in spending on nondurable goods and a 0.1 percent decline in durables expenditures. Spending on services held steady during the month. Over the past year, real spending has grown 2.6 percent, with 12-month comparables for spending on goods and services of +3.9 percent and +2.0 percent, respectively. The increased spending was funded by a 0.4 percent gain in personal income and a 0.5 percent increase in disposable income. Adjusted for inflation, “real” disposable income rose 0.3 percent during the month and was increased 1.6 percent over the past year. The savings rate improved by 2/10ths of a percentage point to +3.2 percent.

Consumer spending barely budged in October. The Bureau of Economic Analysis reports that personal consumption expenditures (PCE) increased 0.3 percent during the month to a seasonally adjusted annualized rate (SAAR) of $13.557 trillion, up 0.3 percent from September. But after adjusting for inflation, “real” PCE grew only 0.1 percent during October following a 0.5 percent bounce in September (although some of September’s spending surge reflected hurricane-related automobile purchases). Real spending on goods grew 0.3 percent, split between a 0.5 percent gain in spending on nondurable goods and a 0.1 percent decline in durables expenditures. Spending on services held steady during the month. Over the past year, real spending has grown 2.6 percent, with 12-month comparables for spending on goods and services of +3.9 percent and +2.0 percent, respectively. The increased spending was funded by a 0.4 percent gain in personal income and a 0.5 percent increase in disposable income. Adjusted for inflation, “real” disposable income rose 0.3 percent during the month and was increased 1.6 percent over the past year. The savings rate improved by 2/10ths of a percentage point to +3.2 percent.

There was a second straight sharp monthly rise in new home sales during October. The Census Bureau estimates new home sales jumped 6.2 percent to a seasonally adjusted annualized rate (SAAR) of 685,000 units. This was up a robust 18.7 percent from a year earlier. Sales grew in all four Census regions on both a month-to-month and year-to-year basis, with the latter showing double-digit percentage gain in each region. Inventories of unsold new homes at the end of October was at 282,000 units, up 1.4 percent for the month and 13.7 percent from a year earlier. Nevertheless, this reflected a tight 4.9 month supply. The median sales price of new homes—$312,800—was 3.3 percent above the October 2016 median sales price.

There was a second straight sharp monthly rise in new home sales during October. The Census Bureau estimates new home sales jumped 6.2 percent to a seasonally adjusted annualized rate (SAAR) of 685,000 units. This was up a robust 18.7 percent from a year earlier. Sales grew in all four Census regions on both a month-to-month and year-to-year basis, with the latter showing double-digit percentage gain in each region. Inventories of unsold new homes at the end of October was at 282,000 units, up 1.4 percent for the month and 13.7 percent from a year earlier. Nevertheless, this reflected a tight 4.9 month supply. The median sales price of new homes—$312,800—was 3.3 percent above the October 2016 median sales price.

Purchasing managers indicate slightly slower growth in manufacturing during November. The Purchasing Managers Index (PMI) from the Institute for Supply Management slipped by 5/10ths of a point to a seasonally adjusted reading of 58.2. Even with the decline, this was the 15th straight month in which the measure above a reading of 50.0, which is indicative of an expanding manufacturing sector. Two of the five components of the PMI grew during the month: production (up 2.9 points to 63.9) and new orders (up 6/10ths of a point to 64.0). Dropping were measures for supplier deliveries (down 4.9 points to 56.5), inventories (down a full point to 47.0), and employment (off 1/10th of a point to 59.7). Fourteen of 18 tracked manufacturing industries expanded during the month, led by paper products, machinery, and transportation equipment.

Purchasing managers indicate slightly slower growth in manufacturing during November. The Purchasing Managers Index (PMI) from the Institute for Supply Management slipped by 5/10ths of a point to a seasonally adjusted reading of 58.2. Even with the decline, this was the 15th straight month in which the measure above a reading of 50.0, which is indicative of an expanding manufacturing sector. Two of the five components of the PMI grew during the month: production (up 2.9 points to 63.9) and new orders (up 6/10ths of a point to 64.0). Dropping were measures for supplier deliveries (down 4.9 points to 56.5), inventories (down a full point to 47.0), and employment (off 1/10th of a point to 59.7). Fourteen of 18 tracked manufacturing industries expanded during the month, led by paper products, machinery, and transportation equipment.

A measure of consumer sentiment hit another 17-year high. The Conference Board’s Consumer Confidence Index added 3.3 points during November to a seasonally adjusted reading of 129.5 (1985=100). This was up 20.1 points from its November 2016 reading and represented the measure’s highest point since November 2000 (132.6). The present conditions index grew by 1.9 points to 152.0 while the expectations index gained 4.3 points to 113.3. 34.9 percent of survey respondents said that current economic conditions were “good” while only 12.7 percent indicated that conditions were “bad.” Similarly, 37.1 percent of consumers report that jobs were “plentiful” while only 16.9 percent said that they were “hard to get.” The press release noted that consumers were “entering the holiday season in very high spirits and foresee the economy expanding at a healthy pace into the early months of 2018.”

A measure of consumer sentiment hit another 17-year high. The Conference Board’s Consumer Confidence Index added 3.3 points during November to a seasonally adjusted reading of 129.5 (1985=100). This was up 20.1 points from its November 2016 reading and represented the measure’s highest point since November 2000 (132.6). The present conditions index grew by 1.9 points to 152.0 while the expectations index gained 4.3 points to 113.3. 34.9 percent of survey respondents said that current economic conditions were “good” while only 12.7 percent indicated that conditions were “bad.” Similarly, 37.1 percent of consumers report that jobs were “plentiful” while only 16.9 percent said that they were “hard to get.” The press release noted that consumers were “entering the holiday season in very high spirits and foresee the economy expanding at a healthy pace into the early months of 2018.”

Other U.S. economic data released over the past week:

– Jobless Claims (week ending November 25, 2017, First-Time Claims, seasonally adjusted): 238,000 (-2,000 vs. previous week; -44,000 vs. the same week a year earlier). 4-week moving average: 242,250 (-3.0% vs. the same week a year earlier).

– Construction Spending (October 2017, Value of Construction Put in Place, seasonally adjusted annualized rate): $1.242 trillion (+1.4% vs. September 2017, +2.9% vs. October 2016).

– Vehicle Sales (November 2017, Light Vehicle Retail Sales, seasonally adjusted annualized rate): 17.48 million vehicles (-3.4% vs. October 2017, -1.3% vs. November 2016).

– Pending Home Sales (October 2017, Index (2001=100), seasonally adjusted): 109.3 (+3.5% vs. September 2017, -0.6% vs. October 2016).

– Beige Book

– FHFA House Price Index (September 2017, Purchase-Only Index, seasonally adjusted): +0.3% vs. August 2017, +6.3% vs. September 2016.

– Case-Shiller Home Price Index (September 2017, 20-City Index, seasonally adjusted): +0.5% vs. August 2017, +6.2% vs. September 2016).

The opinions expressed here are not necessarily those of Kevin’s current and previous employers. No endorsements are implied.