Consumer spending, a critical contributor to GDP growth, wobbled in August. Here are the five things we learned from U.S. economic data released during the week ending September 27.

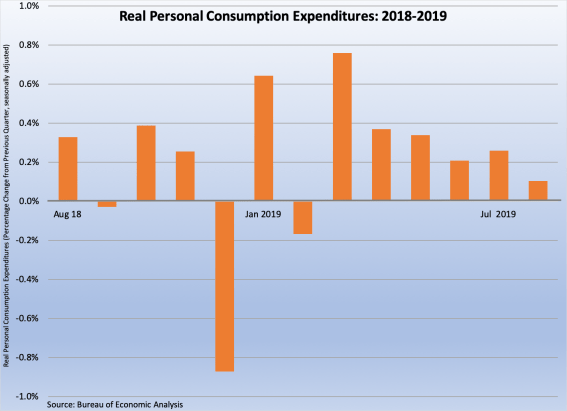

Personal spending growth weakened in August. The Bureau of Economic Analysis reports that “real” personal consumption expenditures (PCE) increased by only 0.1 percent (seasonally adjusted) during the month, its slowest growth rate since a decline in February. Spending on goods rose 0.3 percent, split between a 0.9 percent bounce for durable products and nondurable goods eking out a 0.1 percent increase. Spending on services held steady during the month. Nominal (not adjusted for inflation) consumer spending also grew 0.1 percent, funded by a 0.4 percent increase in nominal personal income and sharp gains for both nominal (+0.5 percent) and real (+0.4 percent) disposable income. The savings rate edged up by 3/10ths of a percentage point to +8.1 percent. Real personal spending has risen 2.3 percent over the past year, while real disposable income has grown 3.0 percent.

Personal spending growth weakened in August. The Bureau of Economic Analysis reports that “real” personal consumption expenditures (PCE) increased by only 0.1 percent (seasonally adjusted) during the month, its slowest growth rate since a decline in February. Spending on goods rose 0.3 percent, split between a 0.9 percent bounce for durable products and nondurable goods eking out a 0.1 percent increase. Spending on services held steady during the month. Nominal (not adjusted for inflation) consumer spending also grew 0.1 percent, funded by a 0.4 percent increase in nominal personal income and sharp gains for both nominal (+0.5 percent) and real (+0.4 percent) disposable income. The savings rate edged up by 3/10ths of a percentage point to +8.1 percent. Real personal spending has risen 2.3 percent over the past year, while real disposable income has grown 3.0 percent.

The third estimate of Q2 GDP continued to indicate modest growth earlier this year, held up by consumer spending. The Bureau of Economic Analysis’ third estimate of gross domestic product (GDP) has the U.S. economy expanding 2.0 percent on a seasonally adjusted annualized rate (SAAR) of +2.0 percent. This matched the second estimate reported a month earlier and was slower than the 3.1 percent annualized growth estimate for the first three months of 2019. Consumers and government spending drove Q2’s economic expansion—the former contributed 303-basis points to GDP growth while government expenditures (both federal and state/local) added 82-basis points. Dragging down economic activity were net exports (shedding 98-basis points to GDP growth), changes in private inventories (-91-basis points), fixed business investment (-25-basis points), and fixed residential investment (-11-basis points). The same report finds corporate profits rose 3.8 percent during Q2, although they were up by a more moderate 1.3 percent compared to the same quarter a year earlier. We will see the first estimate of Q3 GDP on October 30.

The third estimate of Q2 GDP continued to indicate modest growth earlier this year, held up by consumer spending. The Bureau of Economic Analysis’ third estimate of gross domestic product (GDP) has the U.S. economy expanding 2.0 percent on a seasonally adjusted annualized rate (SAAR) of +2.0 percent. This matched the second estimate reported a month earlier and was slower than the 3.1 percent annualized growth estimate for the first three months of 2019. Consumers and government spending drove Q2’s economic expansion—the former contributed 303-basis points to GDP growth while government expenditures (both federal and state/local) added 82-basis points. Dragging down economic activity were net exports (shedding 98-basis points to GDP growth), changes in private inventories (-91-basis points), fixed business investment (-25-basis points), and fixed residential investment (-11-basis points). The same report finds corporate profits rose 3.8 percent during Q2, although they were up by a more moderate 1.3 percent compared to the same quarter a year earlier. We will see the first estimate of Q3 GDP on October 30.

A snapshot of economic measures suggests business activity picked up in August. A weighted index of 85 economic measures, the Chicago Fed National Activity Index (CFNAI), jumped by 51-basis points during the month to a reading of +0.10. Since a 0.00 reading for the CFNAI suggests the U.S. economy is expanding at its historical rate, the positive mark here indicates above-average economic growth during August. The CFNAI’s three-month moving average crept up by eight-basis points to -0.06 (its best reading since January). Forty-four of the 85 indicators made positive contributions to the headline index. All four major categories of indicators improved during the month: production (up 42-basis points to +0.16), sales/orders/inventories (up five-basis points to -0.02), employment (up three-basis points to -0.02), and personal consumption/housing (up a basis point to -0.02).

A snapshot of economic measures suggests business activity picked up in August. A weighted index of 85 economic measures, the Chicago Fed National Activity Index (CFNAI), jumped by 51-basis points during the month to a reading of +0.10. Since a 0.00 reading for the CFNAI suggests the U.S. economy is expanding at its historical rate, the positive mark here indicates above-average economic growth during August. The CFNAI’s three-month moving average crept up by eight-basis points to -0.06 (its best reading since January). Forty-four of the 85 indicators made positive contributions to the headline index. All four major categories of indicators improved during the month: production (up 42-basis points to +0.16), sales/orders/inventories (up five-basis points to -0.02), employment (up three-basis points to -0.02), and personal consumption/housing (up a basis point to -0.02).

Consumer sentiment measures in September reflected uncertainty. The Conference Board’s Consumer Confidence Index shed 9.2 points during the month to a seasonally adjusted reading of 125.1 (1985=100). Both the current and expected conditions indices fell—the former lost 7.0 points to 169.0 while the latter slumped by 10.6 points to 95.8. While 37.3 percent of survey respondents view current economic conditions as “good” (versus 12.7 percent seeing them as “bad), only 19.0 percent expect conditions will be “better” six months from now (versus 14.3 percent expecting them to “worsen”). The press release said that the “escalation in trade and tariff tensions in late August appears to have rattled consumers,” leading to a “plateauing” of consumer confidence.

Consumer sentiment measures in September reflected uncertainty. The Conference Board’s Consumer Confidence Index shed 9.2 points during the month to a seasonally adjusted reading of 125.1 (1985=100). Both the current and expected conditions indices fell—the former lost 7.0 points to 169.0 while the latter slumped by 10.6 points to 95.8. While 37.3 percent of survey respondents view current economic conditions as “good” (versus 12.7 percent seeing them as “bad), only 19.0 percent expect conditions will be “better” six months from now (versus 14.3 percent expecting them to “worsen”). The press release said that the “escalation in trade and tariff tensions in late August appears to have rattled consumers,” leading to a “plateauing” of consumer confidence.

Meanwhile, the University of Michigan’s Index of Consumer Sentiment added 3.4 points in August to a seasonally adjusted 93.2 (1966Q1=100). Even with gain over the past month, the measure was 6.9 percent below that of a year earlier, reflecting a “slow erosion” in sentiment. Both the current and expected conditions indices advanced during the month (although each had negative 12-month comparables): current conditions (up 3.2 points to 108.5—September 2018: 115.2) and anticipated conditions (up 3.5 points to 83.4—September 2018: 90.5). The press release noted “rising levels” of uncertainty—some “rooted in partisanship” and some based on trade tensions.

Durable goods gained thanks to defense aircraft orders. The Census Bureau estimates new orders for durable manufactured goods increased 0.2 percent in August to a seasonally adjusted $250.7 billion. Even as orders for defense aircraft surged 30.3 percent, transportation goods orders fell 0.4 percent (hurt by a 17.1 percent drop for civilian aircraft and a 0.8 percent decline for motor vehicles). Net of transportation goods, core orders increased 0.5 percent—but the data shows mixed results. New orders rose for primary metals (+1.5 percent), fabricated metals (+1.3 percent), and machinery (+0.6 percent) but fell for electrical equipment/appliances (-1.3 percent) and computers/electronics (-0.3 percent). Also giving pause is the 0.2 percent slip in orders for civilian non-aircraft capital goods, a proxy for business investment.

Durable goods gained thanks to defense aircraft orders. The Census Bureau estimates new orders for durable manufactured goods increased 0.2 percent in August to a seasonally adjusted $250.7 billion. Even as orders for defense aircraft surged 30.3 percent, transportation goods orders fell 0.4 percent (hurt by a 17.1 percent drop for civilian aircraft and a 0.8 percent decline for motor vehicles). Net of transportation goods, core orders increased 0.5 percent—but the data shows mixed results. New orders rose for primary metals (+1.5 percent), fabricated metals (+1.3 percent), and machinery (+0.6 percent) but fell for electrical equipment/appliances (-1.3 percent) and computers/electronics (-0.3 percent). Also giving pause is the 0.2 percent slip in orders for civilian non-aircraft capital goods, a proxy for business investment.

Other U.S. economic data released over the past week:

– Jobless Claims (week ending September 21, 2019, First-Time Claims, seasonally adjusted): 213,000 (+3,000 vs. previous week; -1,000 vs. the same week a year earlier). 4-week moving average: 212,000 (+0.7% vs. the same week a year earlier).

– New Home Sales (August 2019, New Single-Family Home Sales, seasonally adjusted annualized rate): 713,000 (+7.1% vs. July 2019, +18.0% vs. August 2018).

– Pending Home Sales (August 2019, Index (2001=100), seasonally adjusted): 107.3 (vs. July 2019: 105.6, vs. August 2018: 104.7).

– Agricultural Prices (August 2019, Prices Received by Farmers (Index: 2011=100)): +0.8% vs. July 2019, +0.9% vs. August 2018.

The opinions expressed here are not necessarily those of Kevin’s current employer. No endorsements are implied.