Employers added workers again as wage inflation appears to be building a bit. Here are the five things we learned from U.S. economic data released during the week ending September 7.

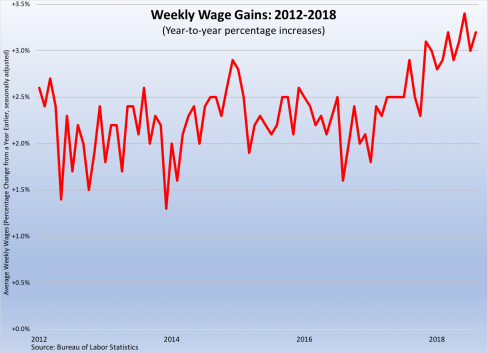

The jobs market (and wages) heated up in August. Nonfarm employment grew by a seasonally adjusted 201,000 workers during the month, up from a 147,000 jobs gain in July, and the 95th straight month of expanding payrolls. The Bureau of Labor Statistics also indicates that private sector employers added 204,000 workers during the month, split between 26,000 in the goods-producing side of the economy and 178,000 in the service sector. Industries adding the most workers during the month included professional/business services (+53,000), health care/social assistance (+40,700), construction (+23,000), wholesale trade (+22,400), and transportation/warehousing (+20,200). The average number of hours worked held steady for the month at 34.5 hours (August 2017: 34.4 hours). Average weekly earnings grew by $3.45 to $937.02, up 3.2 percent from a year earlier, the 5th time the 12-month comparable was at or above 3.0 percent in 2018. For much of this economic recovery, the year-to-year percentage gains ranged between 1.5 and 2.5 percent.

The jobs market (and wages) heated up in August. Nonfarm employment grew by a seasonally adjusted 201,000 workers during the month, up from a 147,000 jobs gain in July, and the 95th straight month of expanding payrolls. The Bureau of Labor Statistics also indicates that private sector employers added 204,000 workers during the month, split between 26,000 in the goods-producing side of the economy and 178,000 in the service sector. Industries adding the most workers during the month included professional/business services (+53,000), health care/social assistance (+40,700), construction (+23,000), wholesale trade (+22,400), and transportation/warehousing (+20,200). The average number of hours worked held steady for the month at 34.5 hours (August 2017: 34.4 hours). Average weekly earnings grew by $3.45 to $937.02, up 3.2 percent from a year earlier, the 5th time the 12-month comparable was at or above 3.0 percent in 2018. For much of this economic recovery, the year-to-year percentage gains ranged between 1.5 and 2.5 percent.

Based on a separate survey of households, the unemployment rate held steady at 3.9 percent, just above the current economic recovery low reading of 3.8 percent achieved in May. At the same time, the labor force contracted by 469,000, resulting in the labor force participation rate slipping by 2/10ths of a percentage point to 62.7 percent. The labor force participation rate for adults aged 25 to 54 was at 82.0 percent, down 1/10th of a point for the month. The typical length of unemployment shrank by 4/10ths of a week to 9.1 weeks (August 2018: 10.3 weeks) while the number of part-time workers seeking a full-time job shrank to another post-recession low at 4.379 million people (August 2017: 5.209 million). The broad measure of labor underutilization by the BLS (the U-6 series) also contracted to a post-recession low of 7.4 percent. A year earlier, the same measure was at 8.6 percent.

The trade deficit widened to its largest reading since February. The Census Bureau and Bureau of Economic Analysis tell us that exports dropped by $2.1 billion to $211.1 billion (+8.2 percent versus July 2017) while imports grew by $2.2 billion to $261.2 billion (+9.1 percent versus July 2017). The resulting trade deficit of $50.1 billion was up $4.3 billion for the month, a 13.3 percent increase from a year earlier, and the largest trade deficit in five months. The goods deficit surged by $4.2 billion to $73.1 billion (+11.8 percent versus July 2017) while the services surplus slipped by $0.1 billion to +$23.1 billion (+8.7 percent versus July 2017). The former fell in part because of lower exports of civilian aircraft and soybeans and increased imports of computers/accessories, fuel/crude oil and automotive vehicles. The U.S. had its largest goods deficits with China (-$34.1 billion), European Union (-$14.5 billion), and Mexico (-$6.4 billion).

The trade deficit widened to its largest reading since February. The Census Bureau and Bureau of Economic Analysis tell us that exports dropped by $2.1 billion to $211.1 billion (+8.2 percent versus July 2017) while imports grew by $2.2 billion to $261.2 billion (+9.1 percent versus July 2017). The resulting trade deficit of $50.1 billion was up $4.3 billion for the month, a 13.3 percent increase from a year earlier, and the largest trade deficit in five months. The goods deficit surged by $4.2 billion to $73.1 billion (+11.8 percent versus July 2017) while the services surplus slipped by $0.1 billion to +$23.1 billion (+8.7 percent versus July 2017). The former fell in part because of lower exports of civilian aircraft and soybeans and increased imports of computers/accessories, fuel/crude oil and automotive vehicles. The U.S. had its largest goods deficits with China (-$34.1 billion), European Union (-$14.5 billion), and Mexico (-$6.4 billion).

Factory orders softened in July but remained well ahead of year-ago levels. The Census Bureau estimates new orders for manufactured goods dropped 0.8 percent during the month to a seasonally adjusted $497.8 billion (+9.0 percent versus July 2017). New orders for transportation goods slumped 5.2 percent, pulled down by declines for both civilian (-35.4 percent) and defense (-34.4 percent) aircraft. Net of transportation goods, orders inched up 0.2 percent to $414.7 billion (+8.4 percent versus July 2017). New orders for civilian capital goods net of aircraft (a measure of business investment) increased 1.6 percent. Shipments improved for the 14th time in 15 months, albeit with a gain of less than 0.1 percent to $501.7 billion (+8.1 percent versus July 2017). The value of unfilled orders of manufactured goods also grew by less than 0.1 percent to $1.165 trillion while inventories expanded by 0.8 percent to $675.8 billion (the 21st straight monthly gain).

Factory orders softened in July but remained well ahead of year-ago levels. The Census Bureau estimates new orders for manufactured goods dropped 0.8 percent during the month to a seasonally adjusted $497.8 billion (+9.0 percent versus July 2017). New orders for transportation goods slumped 5.2 percent, pulled down by declines for both civilian (-35.4 percent) and defense (-34.4 percent) aircraft. Net of transportation goods, orders inched up 0.2 percent to $414.7 billion (+8.4 percent versus July 2017). New orders for civilian capital goods net of aircraft (a measure of business investment) increased 1.6 percent. Shipments improved for the 14th time in 15 months, albeit with a gain of less than 0.1 percent to $501.7 billion (+8.1 percent versus July 2017). The value of unfilled orders of manufactured goods also grew by less than 0.1 percent to $1.165 trillion while inventories expanded by 0.8 percent to $675.8 billion (the 21st straight monthly gain).

Purchasing managers describe strengthening in both the manufacturing and service sectors. The Institute for Supply Management reports that the headline index from its Report on Business in manufacturing (PMI) jumped by 3.2 points during August to a seasonally adjusted 61.3. The measure has been above a reading of 50.0—indicative of an expanding manufacturing sector—for 24 straight months. All five components of the PMI improved during the month: new orders (+4.9 points), production (+4.8 points), supplier deliveries (+2.4 points), inventories (+2.1 points), and employment (+2.0 points). Sixteen of 18 tracked manufacturing industries reported growth, led by computers/electronics, apparel, and textile mills. The press release notes that manufacturers were “overwhelmingly concerned” about impacts of tariffs will have on their business.

Purchasing managers describe strengthening in both the manufacturing and service sectors. The Institute for Supply Management reports that the headline index from its Report on Business in manufacturing (PMI) jumped by 3.2 points during August to a seasonally adjusted 61.3. The measure has been above a reading of 50.0—indicative of an expanding manufacturing sector—for 24 straight months. All five components of the PMI improved during the month: new orders (+4.9 points), production (+4.8 points), supplier deliveries (+2.4 points), inventories (+2.1 points), and employment (+2.0 points). Sixteen of 18 tracked manufacturing industries reported growth, led by computers/electronics, apparel, and textile mills. The press release notes that manufacturers were “overwhelmingly concerned” about impacts of tariffs will have on their business.

The ISM’s measure of nonmanufacturing activity (NMI) added 2.8 points during August to a seasonally adjusted 58.5, the 103rd consecutive month above the expansion/contraction threshold of 50.0. All four NMI components grew from their July readings: business activity/production (+4.2 points), new orders (+3.4 points), supplier deliveries (+3.0 points), and employment (up 6/10ths of a point to 56.7). Sixteen of 18 nonmanufacturing industries gained during August, led by construction, transportation/warehousing, and retail. Per the press release, survey respondents “remain positive about business conditions and the economy” but also report that “logistics, tariffs and employment resources” having an impact on their business.

Vehicle sales held modest in August. Light vehicle retail sales were at a seasonally adjusted annualized rate (SAAR) of 16.72 million units during the month, according to individual automaker sales reports tabulated by Autodata. This was off 0.3 percent from July and up 0.8 percent from a year earlier (although it is worth noting that year ago sales were suppressed by Hurricane Harvey making the 12-month comparable even less impressive). The light truck/SUV sales story improved—growing 2.5 percent during the month to 9.37 million units SAAR (+9.2 percent versus August 2017). Weakness continued on the car side of the market as sales slumped 4.1 percent to 3.77 million units (-15.5 percent versus August 2017).

Vehicle sales held modest in August. Light vehicle retail sales were at a seasonally adjusted annualized rate (SAAR) of 16.72 million units during the month, according to individual automaker sales reports tabulated by Autodata. This was off 0.3 percent from July and up 0.8 percent from a year earlier (although it is worth noting that year ago sales were suppressed by Hurricane Harvey making the 12-month comparable even less impressive). The light truck/SUV sales story improved—growing 2.5 percent during the month to 9.37 million units SAAR (+9.2 percent versus August 2017). Weakness continued on the car side of the market as sales slumped 4.1 percent to 3.77 million units (-15.5 percent versus August 2017).

Other U.S. economic data released over the past week:

– Jobless Claims (week ending September 1, 2018, First-Time Claims, seasonally adjusted): 203,000 (-10,000 vs. previous week; -90,000 vs. the same week a year earlier). 4-week moving average: 209,500 (-16.5% vs. the same week a year earlier).

– Construction Spending (July 2018, Value of Construction Put in Place, seasonally adjusted annualized rate: $1.315 trillion (+0.1% vs. June 2018, +5.8% vs. July 2017).

– Productivity (2nd Quarter 2018-revised, Nonfarm Labor Productivity, seasonally adjusted annualized rate): +2.9% vs. 2018Q1, +1.3% vs. 2017Q2.

The opinions expressed here are not necessarily those of Kevin’s current employer. No endorsements are implied.