For only the 2nd time in a decade, the Federal Reserve raised its short-term interest rate target. Meanwhile, both manufacturing output and retail sales were a bit soft during November. Here are the 5 things we learned from U.S. economic data released during the week ending December 16.

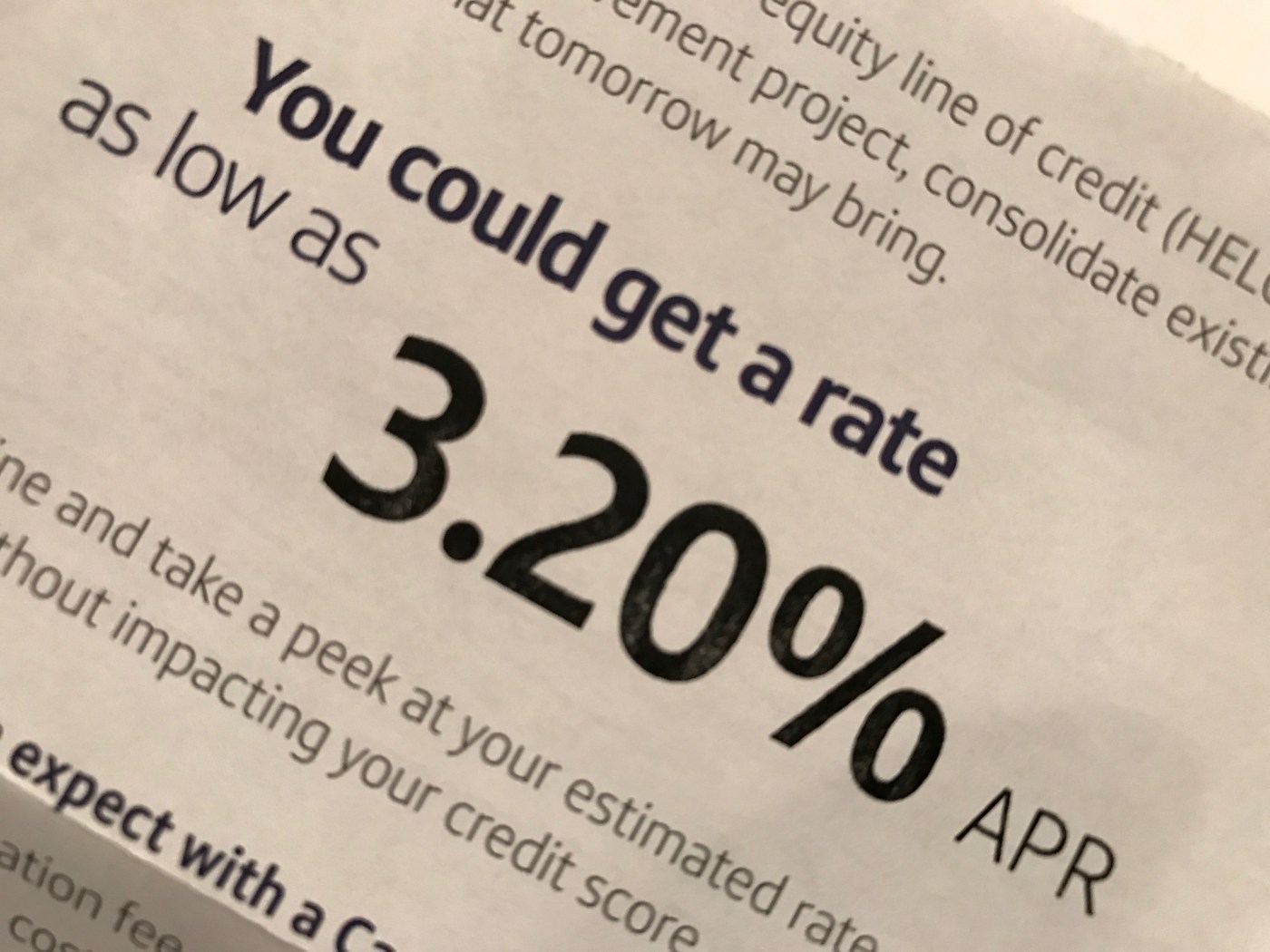

The Fed hikes its short-term interest rate target and forecasts 3 more rate hikes in 2017. The Federal Open Market Committee voted to raise its fed funds target rate by 25-basis points to a range between 0.50% and 0.75%. The policy statement released following the conclusion of the 2-day FOMC meeting noted that the U.S. economy was growing “at a moderate pace” and that labor market had “continued to strengthen.” It also noted that inflation remained below the Fed’s 2 percent target rate (largely from weakness in the prices for energy and imports). The unanimous decision to push up the fed funds target rate was because of “realized and expected labor market conditions and inflation.” Even with the move, the statement characterized the Fed’s monetary stance as “accommodative, thereby supporting some further strengthening in labor market conditions and a return to 2 percent inflation.”

The Fed hikes its short-term interest rate target and forecasts 3 more rate hikes in 2017. The Federal Open Market Committee voted to raise its fed funds target rate by 25-basis points to a range between 0.50% and 0.75%. The policy statement released following the conclusion of the 2-day FOMC meeting noted that the U.S. economy was growing “at a moderate pace” and that labor market had “continued to strengthen.” It also noted that inflation remained below the Fed’s 2 percent target rate (largely from weakness in the prices for energy and imports). The unanimous decision to push up the fed funds target rate was because of “realized and expected labor market conditions and inflation.” Even with the move, the statement characterized the Fed’s monetary stance as “accommodative, thereby supporting some further strengthening in labor market conditions and a return to 2 percent inflation.”

Accompanying the policy statement were updated economic forecasts from the FOMC meeting participants. The median forecast has GDP growth at +2.1% for the upcoming year and 2.0% growth during 2018, the unemployment rate at 4.5% during the next two year, and inflation moving close to the Fed’s 2% target over the period. FOMC participants expect a median of 3 fed fund target rate hikes during both 2017 and 2018 and place the fed funds target rate at between 2.75% and 3.00% by the end of 2019. (It is worth noting that a year ago, the FOMC participants had predicted 4 rate hikes during 2016. It turns out last week’s rate hike was the one and only move the FOMC made this year).

Manufacturing production slipped during November. The Federal Reserve estimate manufacturing sector output slowed 0.1% during the month and was just 0.1% above November 2015 production levels. Output of durable manufactured goods declined 0.3%, reflecting a 2.3% decline in motor vehicle production. Manufacturing of nondurable goods grew 0.3%, as the production of petroleum and coal products surged 3.3%. Overall industrial production dropped 0.4% during November. During the same month, output at utilities plummeted 4.4%, but that in the mining sector gained 1.1%. Capacity utilization declined by 4/10ths of a percentage point to 75.0% (November 2015: 75.7%) while that in manufacturing edged down 1/10th of a percentage point to 74.8% (November 2015: 75.3%).

Manufacturing production slipped during November. The Federal Reserve estimate manufacturing sector output slowed 0.1% during the month and was just 0.1% above November 2015 production levels. Output of durable manufactured goods declined 0.3%, reflecting a 2.3% decline in motor vehicle production. Manufacturing of nondurable goods grew 0.3%, as the production of petroleum and coal products surged 3.3%. Overall industrial production dropped 0.4% during November. During the same month, output at utilities plummeted 4.4%, but that in the mining sector gained 1.1%. Capacity utilization declined by 4/10ths of a percentage point to 75.0% (November 2015: 75.7%) while that in manufacturing edged down 1/10th of a percentage point to 74.8% (November 2015: 75.3%).

Retail sales sputtered in November following several months of strength. The Census Bureau estimates sales of retail and food services edged up 0.1% during the month to a seasonally adjusted $462.3 billion. This followed a 0.6% increase during October, helping put retail sales 3.8% above the year ago pace. Sales at auto dealers and parts stores dropped 0.5%—net of auto dealer transactions, retail sales grew 0.2% during the month and were 3.9% above the November 2015 rate. Sales increased at restaurants/bars (+0.8%), furniture stores (+0.7%), food/beverage stores (+0.4%), and building material retailers (+0.3%). Sales fell at sporting goods/hobby retailers (-1.0%) and department stores (-0.2%). Beyond brick and mortar stores, even though nonstore retailers (including web retailers) saw sales grow a modest 0.1% during the month, they still had a robust 12-month comparable of +11.9%.

Retail sales sputtered in November following several months of strength. The Census Bureau estimates sales of retail and food services edged up 0.1% during the month to a seasonally adjusted $462.3 billion. This followed a 0.6% increase during October, helping put retail sales 3.8% above the year ago pace. Sales at auto dealers and parts stores dropped 0.5%—net of auto dealer transactions, retail sales grew 0.2% during the month and were 3.9% above the November 2015 rate. Sales increased at restaurants/bars (+0.8%), furniture stores (+0.7%), food/beverage stores (+0.4%), and building material retailers (+0.3%). Sales fell at sporting goods/hobby retailers (-1.0%) and department stores (-0.2%). Beyond brick and mortar stores, even though nonstore retailers (including web retailers) saw sales grow a modest 0.1% during the month, they still had a robust 12-month comparable of +11.9%.

Bureau of Labor Statistics’ data show prices continued to firm during November. The Consumer Price Index (CPI) grew 0.2% on a seasonally adjusted basis during the month and was 1.7% above November 2015 levels. Leading the increase was a 1.2% gain in energy CPI, which included a 2.7% bump in gasoline prices. The 12-month comparables for the energy and gas indices were +1.1% and +1.0%, respectively. Food CPI was unchanged for the 5th consecutive month, with the measure off 0.4% from a year earlier. Net of both energy and food goods, core CPI grew 0.2% during the month (its fastest growth rate since August) and was up 2.1% from a year earlier. Rising were prices for transportation services (+0.4%), shelter (+0.3%), used cars/trucks (+0.3%), and medical care services (+0.2%). Falling were prices for apparel (-0.5%), medical commodities (-0.5%), and new vehicles (-0.1%).

Bureau of Labor Statistics’ data show prices continued to firm during November. The Consumer Price Index (CPI) grew 0.2% on a seasonally adjusted basis during the month and was 1.7% above November 2015 levels. Leading the increase was a 1.2% gain in energy CPI, which included a 2.7% bump in gasoline prices. The 12-month comparables for the energy and gas indices were +1.1% and +1.0%, respectively. Food CPI was unchanged for the 5th consecutive month, with the measure off 0.4% from a year earlier. Net of both energy and food goods, core CPI grew 0.2% during the month (its fastest growth rate since August) and was up 2.1% from a year earlier. Rising were prices for transportation services (+0.4%), shelter (+0.3%), used cars/trucks (+0.3%), and medical care services (+0.2%). Falling were prices for apparel (-0.5%), medical commodities (-0.5%), and new vehicles (-0.1%).

Meanwhile, the Producer Price Index (PPI) for final demand grew 0.4% during November, its fastest growth rate since June and leaving the measure of wholesale prices up 1.3% since November 2015. “Core” final demand PPI (net of energy, food, and trade services) was up 0.2% during November and up 1.8% from a year earlier. Wholesale prices for final demand goods also grew 0.2%, which included the impact of a 0.3% drop in energy prices and a 0.6% increase in food prices. PPI for final demand services gained 0.5% during the month as the trade index (tracking margins at retailers and wholesalers) jumped 1.3%.

Housing starts slowed in November, but homebuilder sentiment zoomed to an 11.5 year high in December. The Census Bureau estimates that housing starts slumped 18.7% during November to a seasonally adjusted annualized rate of 1.090 million units. This was also off 6.9% from a year earlier. Starts fell during the month in all 4 Census regions and across home types. In the case of the latter, starts of single-family homes dropped 4.1% during the month while starts of multi-family properties with at least 5 units plummeted 43.9%. Looking towards the future, the number of issued housing permits declined 4.7% during November to a SAAR of 1.260 million permits (-6.6% vs. November 2015). More hopeful was the small increase in issued permits for single-family units (778,000 units, +0.5% vs. October 2016, +5.9% vs. November 2015). Home completions surged 15.4% during the month to 1.216 million units (SAAR, +25.0% vs. November 2015).

Housing starts slowed in November, but homebuilder sentiment zoomed to an 11.5 year high in December. The Census Bureau estimates that housing starts slumped 18.7% during November to a seasonally adjusted annualized rate of 1.090 million units. This was also off 6.9% from a year earlier. Starts fell during the month in all 4 Census regions and across home types. In the case of the latter, starts of single-family homes dropped 4.1% during the month while starts of multi-family properties with at least 5 units plummeted 43.9%. Looking towards the future, the number of issued housing permits declined 4.7% during November to a SAAR of 1.260 million permits (-6.6% vs. November 2015). More hopeful was the small increase in issued permits for single-family units (778,000 units, +0.5% vs. October 2016, +5.9% vs. November 2015). Home completions surged 15.4% during the month to 1.216 million units (SAAR, +25.0% vs. November 2015).

The Housing Market Index (HMI) jumped 7 points to a seasonally adjusted reading of 70. This was the National Association of Home Builders measure’s best reading since July 2005 and was the 30th straight month in which the HMI was above a reading of 50 (indicative of a greater percentage of builders characterizing the housing market as “good” rather than seeing it as “poor”). The HMI grew in all 4 Census regions. Also improving during the month were indices for current sales of single-family homes (up 7 points to 76), expected sales of single-family homes (up 9 points to 78), and traffic of prospective buyers (up 6 points to 53). The press release suggests that the jump in “confidence could be considered an outlier,” (attributed to a post-election “bounce”). But the press release also noted that “the fact remains that the economic fundamentals continue to look good for housing.”

Other U.S. economic data released over the past week:

– Jobless Claims (week ending December 10, 2016, First-Time Claims, seasonally adjusted): 254,000 (-4,000 vs. previous week; -21,000 vs. the same week a year earlier). 4-week moving average: 257,750 (-5.6% vs. the same week a year earlier).

– Manpower Employment Outlook Survey (2017 Q1, Net Employment Outlook, seasonally adjusted): +16 (vs. +18 for 2016 Q4, vs. +17 for 2016 Q1).

– Import Prices (November 2016, not seasonally adjusted): -0.3% vs. October 2016, -0.1% vs. November 2015.

– Export Prices (November 2016, not seasonally adjusted): -0.1% vs. October 2016, -0.3% vs. November 2015.

– Manufacturing & Trade Inventories (October 2016, seasonally adjusted): $1.813 trillion (-0.2% vs. September 2016, +0.4% vs. October 2015).

– Small Business Optimism Index (November 2016, Index (1986=100), seasonally adjusted): 98.4 (October 2016: 94.9, November 2015: 94.5).

– Regional/State Employment (November 2016, Change in Nonfarm Payrolls, seasonally adjusted): Vs. October 2016: Up in 9 states, down 2 states, virtually unchanged in 39 states in the District of Columbia. Vs. November 2015: Up in 31 states and the District of Columbia, down in 1 state, and essentially unchanged in 18 states.

– Federal Treasury Budget (November 2016, Surplus/Deficit): -$136.7 billion (vs. -$44.2 billion in October 2016, vs. -$64.5 billion in November 2015). For 1st 2 months of FY2017: -$180.8 billion (vs. -$201.1 billion during the 1st 2 months of FY2016).

– Treasury International Capital Flows (October 2016, Net Foreign Purchases of Domestic Securities): -$6.0 billion (vs. -$46.6 billion in September 2016, -$45.8 billion in October 2015).

The opinions expressed here are not necessarily those of Kevin’s current and previous employers. No endorsements are implied.